Tips for Improving Your Time-of-Service Collections in 2021

If you’ve noticed an uptick in out-of-pocket costs for your patients recently, it’s not in your head. A recent report found that, between 2006 and 2016, private insurance deductibles and coinsurance rose 176% and 67% respectively – with average deductibles rising from $303 to over $1200 within the decade.

And if you think this is just a problem for low-income patients, think again. Similar research from 2020 found that “catastrophic out-of-pocket healthcare costs” are mainly a problem for middle-income Americans with employer coverage — that’s over half of all working Americans, according to 2019 census data. This doesn’t include the estimated 33 million Americans who lost their job amid the COVID-19 pandemic and may still be struggling to make ends meet with little or no income.

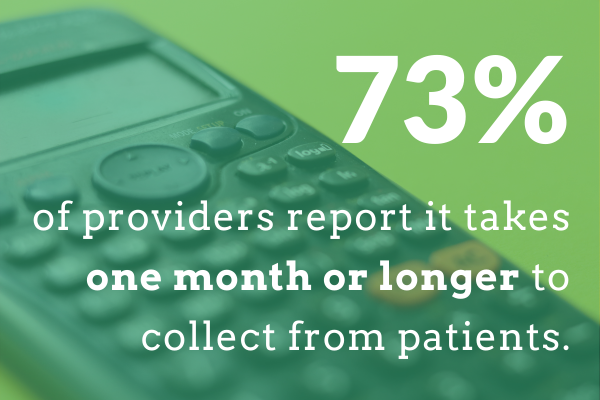

These data make one thing clear: Conversations with your patients about money will only get more challenging this year. Make sure your practice is prepared to successfully navigate the complex world of patient co-pays, coinsurance and deductibles with these tips for improving your time-of-service (TOS) collections strategy in 2021.

Train your staff to talk about money.

The way your staff talks about money can have a measurable impact on the success of your collections efforts, so invest time in showing them how to do it right. You’ll need to consider what your staff is saying to patients as well as how they’re saying it.

Consistency is key in collections, so try using scripts to standardize how your team asks for money. Many payment snafus boil down to simple miscommunication, so scripts are also a great way to ensure your patients know what’s expected of them when it comes to payment.

Beyond the words they use, encourage your team to make eye contact, use a patient’s first name, and annotate a receipt during check-out. All of these non-verbal queues subtly send the message that your practice expects payment.

Hire or Appoint a Patient Financial Counselor.

Discussions about money — especially as they relate to someone’s health — are challenging to navigate even for the most experienced healthcare administrators. Patients who are struggling to cover out-of-pocket costs may find it easier to negotiate payment plans with a single trusted advisor within your practice.

Consider either hiring a Patient Financial Counselor or appointing someone on your existing team. This person can then create a framework for tracking past-due balances, meet with patients who are struggling to make payments on time, and establish a repayment plan with them. Research suggests that Patient Financial Counselors can positively impact the patient experience, so this can also help you keep and attract new patients when you need them most.

Design a collections policy.

Ideally you should collect payment from patients at the time of care, but this isn’t always possible. A clear collections policy for how patients will pay account balances in full or over a period of time will help your team provide more options for patients who may not have enough cash up front at check-out.

The way your collections policy works depends on the needs of your practice, but we recommend starting with a policy of 50% of the balance up front – and if that’s not successful, dividing the balance over four months. If you’re a member of the American Medical Association, you can also download these AMA resources (accessible via login) to help you design the right policy format for your practice.

Establish payment plan agreements.

Once you design a collections policy, make sure you have a framework in place to monitor and enforce it. If you haven’t done so already, establish payment plan agreements in your EMR’s Collection Module and ensure your patients sign it. This will verify they know what happens if they miss a payment and that they understand any late fees or penalties they may incur.

From there, set a cadence for exporting and reviewing reports from your EMR to ensure your patients comply. I recommend doing this at least monthly – and make sure you have a process in place for communicating with patients about their upcoming (or past due) payments as well.

Not sure where to start with payment plan agreements? Download our Payment Plan Template for helpful frameworks to help you get started.

Diversify your payment methods.

Your patients are used to leveraging various methods to pay for things online — and this impacts how those patients prefer to cover out-of-pocket costs with your practice. According to a 2017 Revenue Cycle Management survey, 62% of medical bills were paid online in the first half of 2017 and 95% of consumers polled said they’d pay online if given the option.

If the only option a patient has for paying down a past due balance is to call your office and read out credit card details over the phone, then you are doing your patients (and yourself) a disservice. For better or worse, the “Amazon effect” means patients today expect a streamlined and intuitive digital experience when paying bills online.

To get ahead, diversify your payment methods to include convenient options like credit card on file, Care Credit, and ACH/eChecks — and start thinking about mobile payment options, too. The same survey found that 71% of surveyed patients say that mobile pay and billing alerts have improved their satisfaction with their healthcare provider.

Communicate estimated out-of-pocket costs prior to appointments.

To avoid catching patients off-guard at check-out, provide them with an estimate of their out-of-pocket costs when scheduling their initial appointment – and clearly state they must have this balance prior to being seen. Follow up with clear messaging in all appointment reminders about payment guidelines and options so patients arrive at your office prepared.

This is especially important for patients who are insured with a high-deductible plan and may not be aware they have an obligation to pay for care (or a plan to do so). According to a recent study, collection rates for patient accounts with balances greater than $5,000 were four times lower than collection rates for patient accounts with low-deductible health plans — so don’t let these overdue balances pile up.

Prepare a daily collections “cheat sheet.”

Even the best collections strategy will ultimately fall apart without the right level of preparation. One of the best ways you can keep your team on-track with TOS collections is to prepare helpful “at a glance” resources ahead of time. That way, busy front office team members are less likely to skip over important tasks or make inaccurate assumptions about balances due.

While verifying patients’ insurance details for the following day’s appointments, create a supplementary day sheet indicating amounts owed and reasons for the balance due. Include a chart of allowables by payor to accompany your day sheet and train checkout staff on how to calculate amounts.

For elective surgical patients, train your coordinator to calculate deposits and collect these costs prior to scheduling. Non-acute patients who have outstanding balances should not be scheduled until their balance is paid.

Work with a trusted partner.

Optimizing your TOS collections strategy is a complex process that won’t happen overnight. To help you navigate the process of setting up or improving upon collections processes, revenue cycle management consultants (like us) can help! We streamline the process for you by providing valuable support and guidance for patient co-pay collection, patient responsibility calculation, and more.

If you’re ready to design a new TOS collections program or improve on an existing one in your practice, set up a time to talk with our team. We can walk you through what to expect and which of our services can help!

Recent Comments