Weathering the Storm: Keeping Your Practice Afloat During the Pandemic and Beyond

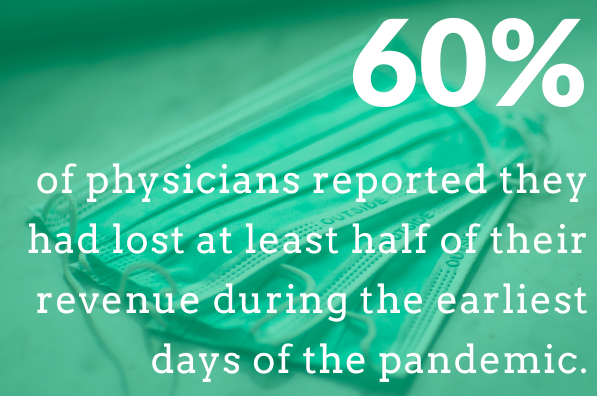

The pandemic began taking its toll on physician practices as early as April 2020. According to a Texas Medical Association poll around that time, 60 percent of physicians reported they had lost at least half of their revenue during the earliest days of the pandemic.

The road to recovery is certainly not without challenges but there is plenty you can do to lower monthly expenses, optimize your staffing plan, and take advantage of financial assistance during and after the second round of the pandemic.

If you’re looking for ways to keep your practice afloat and moving in the right direction in 2021, think outside the box. Patients are looking to return to normalcy, stability, and predictability. Make sure you’re prepared to deliver that experience with these practical tips for keeping your practice afloat this year and beyond.

Tips to Keep Your Practice Profitable

Evaluate staff levels.

Industry leaders estimate staffing can account for 25-40 percent of your total operating expenses, so staff levels are a crucial consideration when it comes to controlling costs. If you are overstaffed according to specialty benchmarks, now is the time to make adjustments.

If you determine that staff reductions are necessary, be open and honest with our staff. In many cases, staff may volunteer due to circumstances at home. If further reductions are necessary there are plenty of options you can consider — including furlough or layoff, exempt vs. non-exempt, etc. There are rules and regulations to consider with each so make sure you do your research.

You can find data to use for establishing benchmarks and guiding staffing plans in the American Medical Association (AMA) Physician Masterfile. Staffing can be a stressful and confusing situation even in the best of times, so contact our team to learn how we can help.

Cut or defer recurring and overhead costs.

You’d be surprised how many ways there are to significantly defer or reduce your overhead costs. Consider the following when evaluating your overall financial situation:

Ask about tax credits and grants.

Contact your CPA or tax professional and ask about available tax credits available to your practice. These same sources may also have valuable information about financial assistance options available to you, including loans and grants.

Request a deferral on rent or mortgage payments.

There are a number of reasons why you may quality for a deferral on your rent or mortgage payments. Familiarize yourself with policy regarding the CARES Act and mortgage forbearance and what it means for your practice.

Explore other small business financial assistance options.

As of April 2021, there are key changes to the Payroll Protection Program (PPP) for Small Businesses (i.e. practices with fewer than 20 employees). These updates are provided on SBA San Antonio website.

Unlock revenue with your existing patient base.

There’s plenty of hidden revenue locked within your existing patient base if you know where to look — and dedicate time and energy to finding it. When looking at your existing financial data and practices processes, focus on the following:

Track and reschedule missed appointments.

Patients navigating scheduling conflicts may have missed or cancelled a prior appointment and simply forgotten to reschedule. If you don’t have an automatic way of rescheduling missed appointments, work with your team to start contacting and scheduling those patients now.

Optimize your time-of-service payments.

The likelihood you will receive a payment on a balance decreases significantly the moment a patient walks out of your practice. Check out these tips for optimizing your TOS strategy to ensure you’re not leaving money on the table.

Understand your insurance coverage options.

Your insurance policies may include coverage for business interruption, so make sure you review your current policy details carefully. If you could not open your business during the Texas Freeze, we also recommend you visit Texas-claims.com and complete their free online evaluation to determine if you are eligible to file for compensation for property damage.

Consider telemedicine (and do your homework).

If you haven’t implemented telemedicine yet, now is the time to explore this exciting new modality for serving patients. You’d be surprised how this will enhance revenue and reschedule missed appointments for busy patients.

If you are serving patients via telemedicine during the pandemic, familiarize yourself with these important telemedicine coding tips to avoid potentially costly pitfalls that arise from billing errors.

Review practice processes for potential inefficiencies.

Make sure you establish a plan and train your team to avoid costly coding and billing errors – but sometimes errors happen. If you do have a claim rejected, make sure you have a workflow for managing these rejected claims in a timely manner. While you’re at it, make sure your encounter notes are promptly closed as well.

How We Can Help

Zenith has the practice viability resources available including expert coders, reimbursement specialists, hands-on practice management consulting, and other professionals to help physicians successfully navigate beyond COVID into 2021. Contact our team to learn about how we can help you become a more efficient and profitable practice.

Recent Comments